Saturday, November 8, 2025

Ka‘iwakīloumoku Hawaiian Cultural Center

Kamehameha Schools Kapālama

The Ambassadors of Aloha ‘Āina recently hosted a benefit dinner, an evening alive with the sights, sounds, and spirit of aloha. From the beauty of hula, and the power of passionate oli, every moment resonated with the heartbeat of our culture. Guests were surrounded by the melodies of Hawaiian music legends, Mel Amina, Moon Kauakahi, and Eric Lee, kumu and haumāna musicians, ‘ono food, and the warm hospitality of ‘ōpio and ‘ohana.

Founded in 2015 at Kamehameha Schools Kapālama, the Ambassadors of Aloha ‘Āina program empowers students to learn, connect, and represent our lāhui abroad, fulfilling King David Kalākaua’s vision of cultivating future ‘ōiwi leaders through global diplomacy and cultural exchange, which strengthens Hawaiian culture and identity.

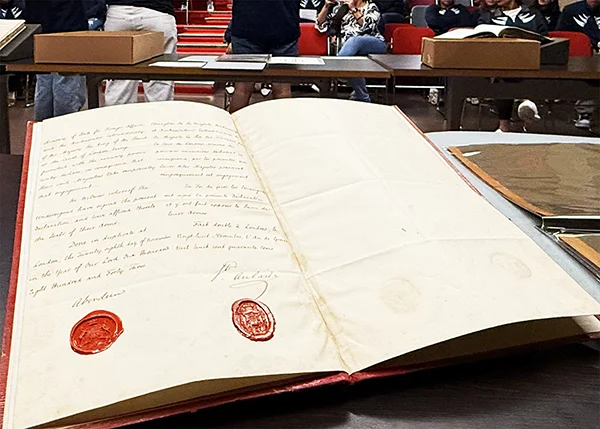

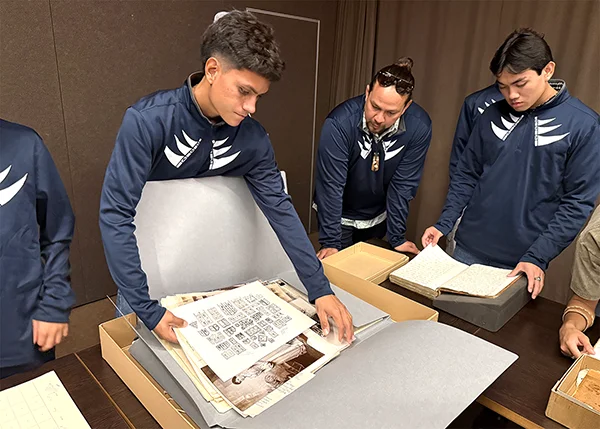

Thanks to the incredible generosity of our donors, the event raised more than $30,000 to support the 68 haumāna traveling to London in March 2026 to experience the Hawai‘i: a kingdom crossing oceans exhibition at the British Museum which they helped co-curate, thanks to a unique invitation from Dr. Alice Christophe, curator and head of Oceania. This once-in-a-lifetime opportunity is born of the October 2024 huaka‘i to Scotland and England, carrying forward the diplomatic legacy of our ali‘i in this rising generation of haumāna.

Every dollar raised helps cover essential travel expenses, including airfare, accommodations, and related costs, making this trip possible for haumāna as without the generous support of donors, many of our students would not have the opportunity to participate in this program.

Your gift helps create opportunities for haumāna to engage in leadership at an international level, ensuring that the traditions of our kūpuna are strengthened, inspiring future generations to stand proudly in their heritage.

To learn more about the Ambassadors of Aloha ‘Āina program, contact Karen Yasuhara at eeyasuha@ksbe.edu or call (808) 534-8360.